stamp duty malaysia for contract agreement calculator

Every sweet feature you might think of is already included in the price so there will be no unpleasant surprises at the checkout. Follow Loanstreet on Facebook Instagram for the latest updates.

Second Amended And Restated Credit Agreement Dated March 28 Regal Beloit Corp Business Contracts Justia

Создание нового журнала.

. EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Basically the Stamp Duty for Tenancy Agreements spanning less than one year is RM1 for every RM250 of the annual rent in excess of RM2400.

Copy of the Allotment Letter Buyer Agreement. An inheritance tax is a tax paid by a person who inherits money or property of a person who has died whereas an estate tax is a levy on the estate money and property of a person who has died. Tool requires no monthly subscription.

SPA Stamp Duty MOTDOA Sub Total RM. The agreement isnt valid including circumstances when the agreement is verbal If you feel that you meet these criteria contact your states tribunal and provide evidence to support your claim. Generally it is easy to calculate stamp duty according to the rates provided by the Indian Stamp Act or the State.

By logging in to LiveJournal using a third-party service you accept LiveJournals User agreement. Learn the specific estate planning documents you need to protect yourself and your loved ones. This means that if one day you decide to sell your house you have to pay taxes on the profit gains if you have any.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Stamp duty on rental agreements. Legal Fees.

The stamp duty is to be made by the purchaser or buyer and not the seller. Content Writer 247 Our private AI. A sale and purchase agreement in Malaysia is one of the most important documents youll encounter when you buy a house.

Or 94 of the contract sum only to see 29 of renovation work completed since signing the agreement in July 2021. Latest news expert advice and information on money. B sends an email from Singapore accepting As offer.

Another way to determine whether a contract is one of service or for services is explained by the Federal Court in Hoh Kiang Ngan v Mahkamah Perusahaan Malaysia Anor 1996 4 CLJ 687 where Gopal Sri Ram JCA stated that the degree of control also known as the Control Test of which an employer exercises over a claimant is an important factor. International tax law distinguishes between an estate tax and an inheritance tax citation needed an estate tax is assessed on the assets of the deceased while an inheritance tax is. Plan for your future today.

A full stamp duty exemption is given on. For contracts that are signed for anywhere between 1 to 3 years the stamp duty rate is RM2 for every RM250 of the annual rent in excess of RM2400. A sends an email from Malaysia offering to sell property to B.

Where the Contract or Agreement is executed signed overseas BSD and ABSD must be paid within 30 days after the receipt of the Contract or Agreement in Singapore. Receipts of initial payments made to the seller. This lets us find the most appropriate writer for any type of assignment.

Over 500000 Words Free. Pensions property and more. Stamp duty is payable under Section 3 of the Indian Stamp Act 1899.

BSD and ABSD must be paid within 14 days after the date of the signed Contract or Agreement. The assessment and collection of stamp duties is governed by the Stamp Act 1949. Sign Up for Talks.

This lets us find the most appropriate writer for any type of assignment. Receipts of payments made to the developer. Real Property Gains Tax RPGT is a form of Capital Gains Tax that homeowners and businesses have to pay when disposing of their property in Malaysia.

Copy of the agreement to sell if already executed For Construction. Instruments of transfer and loan agreement for the purchase of residential homes priced between RM300000 to RM25 million will enjoy a stamp duty exemption. This is subject to a minimum 10 discount by the developer and an exemption on the instrument of transfer is limited to the first RM1 million of the property price.

That starts with tenants rights and tenancy agreement in Malaysia along with 7 important dos and donts. The minimum retirement age for employees in Malaysia is regulated by the Minimum Retirement Age Act 2012 which came into force on 1 July 2013. Stamp duty calculator Estimate your propertys BSD and ABSD.

Delay in payment of stamp duty can make the individual liable to pay a fine ranging from 2 to 200 of the total payable amount. The SPA is a legally binding contract which outlines the details of a sale between a buyer and a seller. You need to pay a stamp duty when you buy a property and also when you go in for a rental agreement.

Contract or Agreement eg. During the rental period participants pay rent usually above the market average as well as an ongoing fee for the option to buy the property at the end of the contract. Also read all about income tax provisions for TDS on rent.

Some rent-to-buy contracts also require the participant to cover additional outgoings such as building maintenance stamp duty and insurance. There are two types of stamp duties which are ad valorem duty and fixed duty. Title Deeds of the Plot.

Stamp Duty is a tax on dutiable documents relating to immovable properties in Singapore and stocks and shares. Chat with your writer and come to an agreement about the most suitable price for you. Title Deeds including previous chain of the property documents.

Engine as all of the big players - But without the insane monthly fees and word limits. These contract work include cement flooring air-con purchase and installation carpentry electrical works plumbing painting and so on. For example if you need to break your lease due to financial hardship provide bank statements income statements and termination letters if you.

Lets stress again if you terminate a rental contract agreement early. To date the various. Stamping fee calculated for every RM250 in excess of a RM2400 annual rent Up to 1 year.

Stamp duty is the governments charge levied on different property transactions. Sale and Purchase Agreement and Transfer Instruments for Shares. Any retirement age of less than 60 in an employment contract or collective.

A document is considered to be duly stamped only when stamp duty is fully paid. And if the Tenancy Agreement has been signed for more than 3 years the. This is effected under Palestinian ownership and in accordance with the best European and international standards.

Upcoming Past Talks. And here are 4 of the more important points to pay attention to. Stamp duty is the amount of tax levied on your property documents such as the Sales and Purchase Agreements SPA the Memorandum of Transfer MOT and the loan agreement.

10 Steps To Buying A Property Malaysian Litigator

Spa Stamp Duty Mot Calculator Legal Fees Calculator Properly

Malaysia 2021 Vs 2022 Stamp Duty On Share Trading Contract Notes Youtube

Upfront Costs Of Purchasing A Home In Malaysia Propsocial

Malaysia Real Estate Kuala Lumpur Property Legal Fees Stamp Duty Calculation When Buying A House In Malaysia

Buildings Free Full Text Early Experience Of Land Readjustment In Hong Kong Case Study Of The Kowloon Walled City Html

Stamp Duty On Mot Stamp Duty Calculator Malaysia Malaysiacalculator Com

What Is Stamp Duty Everything To Know About Malaysia Stamp Duty

Drafting And Stamping Tenancy Agreement

Stamp Duty And Contracts Yee Partners

Legality Of Backdating Agreements

Buying A House Here S 2022 Stamp Duty Charges Other Costs Involved

Upfront Costs Of Purchasing A Home In Malaysia Propsocial

What To Remember About Stamp Duty In Malaysia

How To Calculate Stamp Duty 2022 Malaysia Housing Loan

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

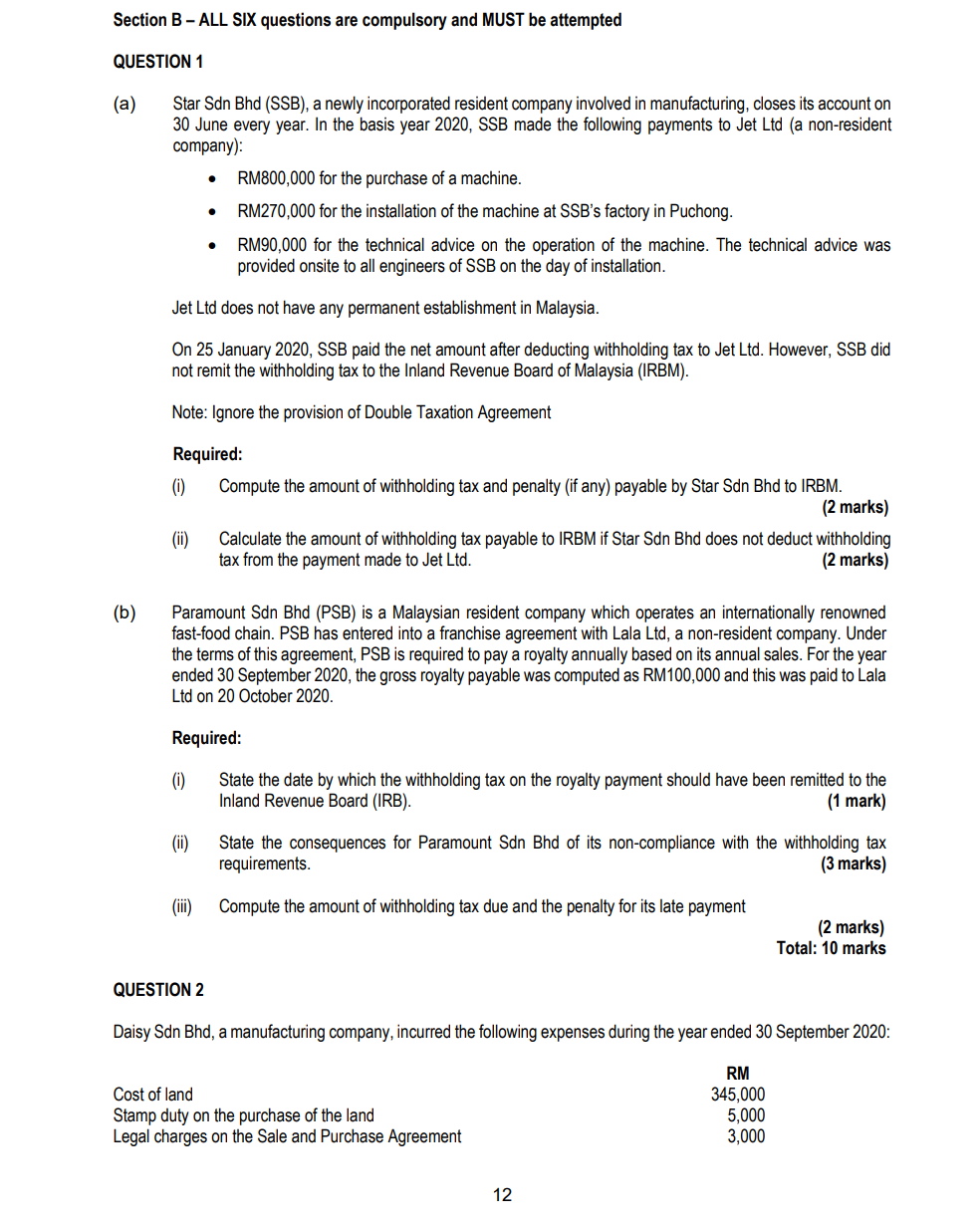

Section B All Six Questions Are Compulsory And Must Chegg Com

Rental Agreement Stamp Duty Malaysia Speedhome

0 Response to "stamp duty malaysia for contract agreement calculator"

Post a Comment